All Categories

Featured

Table of Contents

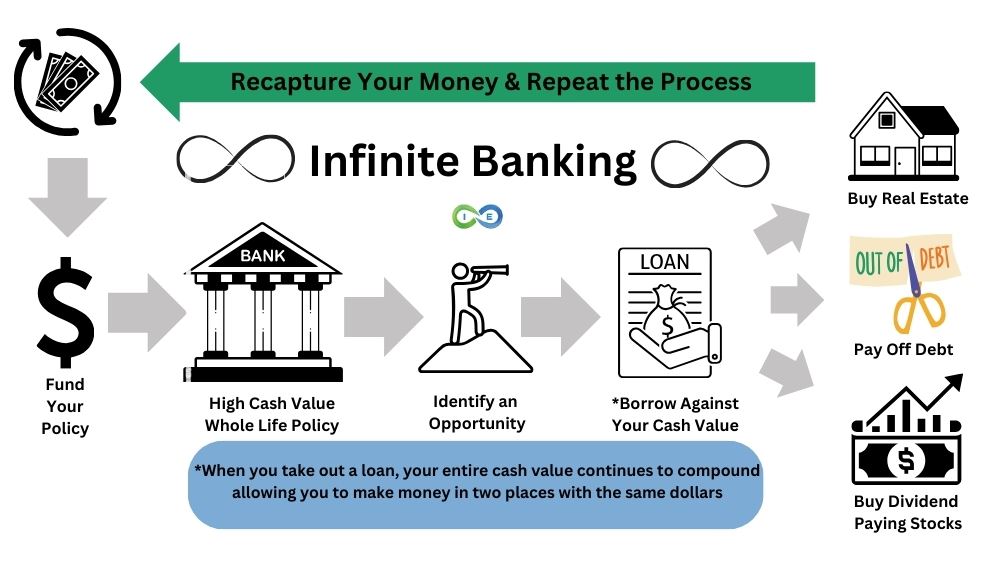

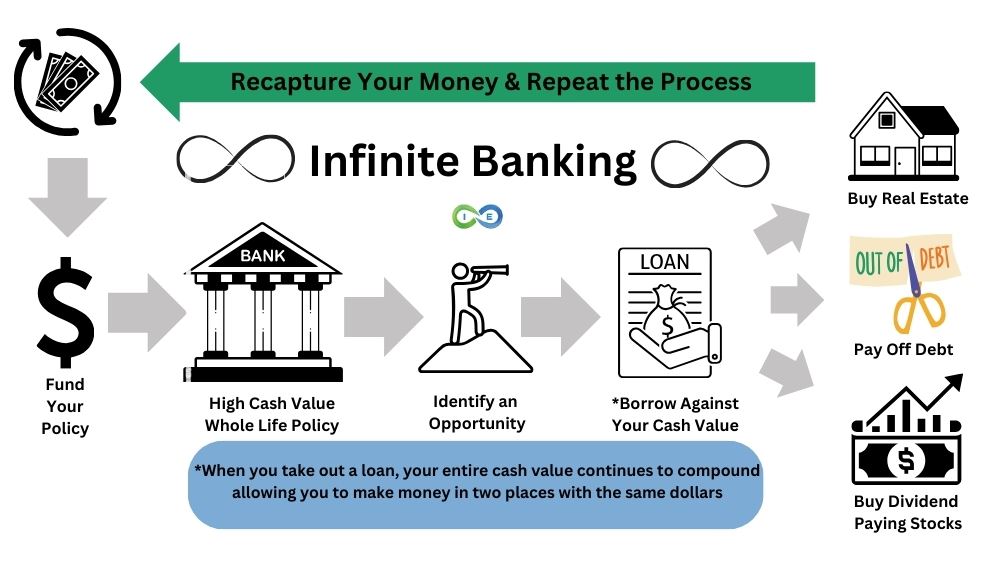

The repayments that would have otherwise gone to a banking establishment are paid back to your personal swimming pool that would certainly have been used. Even more cash goes right into your system, and each buck is executing multiple jobs.

This money can be made use of tax-free. The money you utilize can be paid back at your recreation with no set settlement timetable.

This is exactly how family members pass on systems of wide range that make it possible for the future generation to follow their dreams, begin businesses, and capitalize on opportunities without shedding it all to estate and estate tax. Firms and banking establishments utilize this approach to produce working swimming pools of resources for their companies.

What are the benefits of using Infinite Banking for personal financing?

Walt Disney utilized this strategy to begin his imagine building a theme park for youngsters. We 'd love to share a lot more instances. The inquiry is, what do desire? Peace of mind? Financial safety and security? A sound monetary remedy that does not count on a fluctuating market? To have cash for emergencies and chances? To have something to pass on to individuals you like? Are you ready to learn even more? Financial Planning Has Failed.

Sign up with one of our webinars, or go to an IBC bootcamp, all at no cost. At no price to you, we will certainly show you extra about exactly how IBC works, and develop with you a strategy that works to solve your issue. There is no obligation at any factor while doing so.

This is life. This is heritage (Life insurance loans). Contact one of our IBC Coaches right away so we can show you the power of IBC and whole life insurance policy today. ( 888) 439-0777.

It appears like the name of this principle changes once a month. You might have heard it referred to as a perpetual riches approach, family members financial, or circle of riches. Regardless of what name it's called, boundless financial is pitched as a secret means to develop wealth that just rich people learn about.

Infinite Banking For Retirement

You, the policyholder, put cash into an entire life insurance policy plan through paying premiums and purchasing paid-up additions. This boosts the cash value of the plan, which indicates there is more cash money for the dividend price to be put on, which typically suggests a higher price of return in general. Reward prices at significant service providers are presently around 5% to 6%.

The whole principle of "banking on yourself" only functions since you can "financial institution" on yourself by taking finances from the policy (the arrowhead in the chart over going from whole life insurance policy back to the insurance policy holder). There are 2 different kinds of lendings the insurance policy company might supply, either straight recognition or non-direct acknowledgment.

One attribute called "wash lendings" sets the rates of interest on fundings to the very same price as the returns price. This indicates you can borrow from the policy without paying rate of interest or receiving rate of interest on the amount you borrow. The draw of infinite banking is a dividend rate of interest and ensured minimal price of return.

The drawbacks of limitless financial are typically overlooked or otherwise stated in any way (much of the info offered concerning this principle is from insurance representatives, which may be a little biased). Just the money worth is expanding at the dividend rate. You likewise have to pay for the price of insurance policy, charges, and costs.

Is Infinite Banking In Life Insurance a good strategy for generational wealth?

Every long-term life insurance coverage plan is various, however it's clear someone's total return on every dollar spent on an insurance coverage product can not be anywhere close to the returns rate for the policy.

To offer an extremely fundamental and theoretical instance, let's think a person is able to gain 3%, usually, for each buck they invest in an "limitless banking" insurance item (nevertheless expenses and charges). This is double the estimated return of whole life insurance policy from Customer Reports of 1.5%. If we assume those bucks would certainly be subject to 50% in taxes complete otherwise in the insurance item, the tax-adjusted rate of return can be 4.5%.

We think greater than typical returns on the entire life item and a really high tax obligation price on dollars not place into the plan (which makes the insurance item look much better). The reality for lots of folks might be worse. This fades in contrast to the long-lasting return of the S&P 500 of over 10%.

Can I use Infinite Wealth Strategy to fund large purchases?

Limitless financial is a great item for agents that offer insurance coverage, yet may not be optimal when contrasted to the more affordable options (with no sales individuals making fat compensations). Below's a malfunction of several of the various other supposed advantages of infinite banking and why they might not be all they're broken up to be.

At the end of the day you are getting an insurance item. We love the security that insurance uses, which can be acquired a lot less expensively from a low-priced term life insurance policy plan. Unsettled lendings from the plan may also minimize your fatality benefit, diminishing another degree of protection in the policy.

The idea only works when you not just pay the considerable costs, but utilize additional money to acquire paid-up enhancements. The chance cost of all of those dollars is incredible incredibly so when you could instead be investing in a Roth IRA, HSA, or 401(k). Even when contrasted to a taxed financial investment account or perhaps an interest-bearing account, limitless banking may not provide comparable returns (compared to investing) and similar liquidity, accessibility, and low/no cost structure (contrasted to a high-yield interest-bearing accounts).

As a matter of fact, several individuals have never ever listened to of Infinite Banking. We're here to transform that. Infinite Banking is a method to handle your cash in which you create a personal financial institution that works similar to a normal financial institution. What does that mean? Well, we claimed that traditional banks are used for storage space centers and financing.

How do I qualify for Generational Wealth With Infinite Banking?

Just placed, you're doing the financial, however rather of depending on the standard bank, you have your own system and full control.

Infinite Financial isn't called in this way without a reasonwe have unlimited ways of applying this procedure right into our lives in order to genuinely have our lifestyle. In today's short article, we'll reveal you 4 various ways to make use of Infinite Financial in organization. We'll go over 6 methods you can use Infinite Banking directly.

Latest Posts

Infinite Banking Insurance Companies

Become Your Own Bank

Life Insurance Be Your Own Bank